Back

Glossary

Commercial Real Estate Data Analytics

Understanding Commercial Real Estate (CRE) Data Analytics Across Properties and Portfolios

Key takeaways:

Commercial real estate data analytics turns property, market, and financial information into a shared view of how assets perform, where risk builds, and how value changes across portfolios.

For CRE firms, analytics makes it possible to see how changes in demand, pricing, costs, and exposure develop over time, supporting more consistent decisions around valuation, leasing, and capital planning.

Visitt's approach to data analytics is grounded in operational data captured automatically from work orders, inspections, compliance tasks, tenant communication, and vendor activity, then connected across workflows to inform actionable decisions.

What is commercial real estate (CRE) data analytics?

Commercial real estate data analytics refers to the use of software tools to collect, process, and learn from data related to properties, markets, and economic conditions, supporting daily operational and long-term strategic decisions across CRE portfolios.

It brings together commercial real estate property data on:

- Leases

- Occupancy

- Maintenance activity

- Pricing history

- Operational cost data

- Commercial property inspections

- Energy use

- Tenant behavior

- Various market trends and indicators

In practice, data analytics in commercial real estate supports building operations, facility management, leasing, and risk management, keeping the data aligned and actionable across assets and portfolios. AI plays a significant role in the data analytics process by handling large volumes of data as it enters the system, refreshing forecasts and highlighting changes in performance, demand, or exposure that would be difficult to track manually across growing portfolios.

Common features found in commercial real estate data and analytics platforms include:

- Market trend analysis

- Property valuation models

- Risk assessment tools

- Portfolio management views

- Data visualization through charts, heat maps, and dashboards

How does CRE data analytics work?

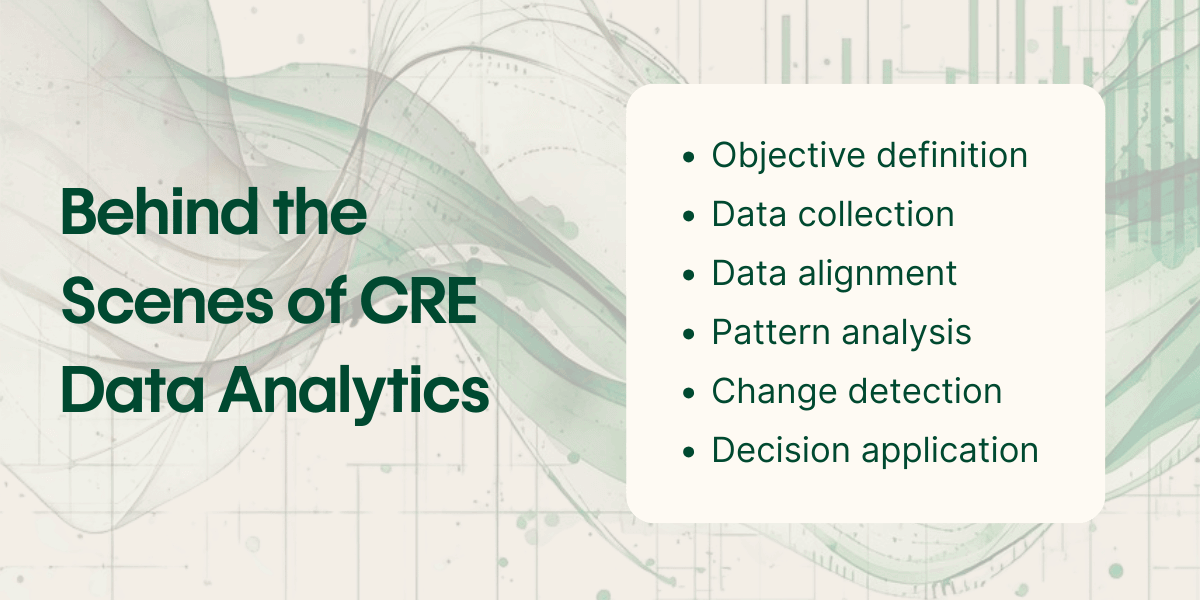

CRE data analytics follows a clear process that turns raw data into insight teams can act on.

- Objective definition: A clear question is set, such as portfolio performance review, acquisition evaluation, or risk assessment.

- Data collection: Data is gathered from leases, financials, market sources, and systems like work order management, CMMS, inspections, and compliance tools.

- Data alignment: Information from different systems is standardized and connected for consistent review across assets and portfolios.

- Pattern analysis: Trends in occupancy, pricing, costs, and risk are evaluated, often supported by AI in commercial real estate for forecasting.

- Change detection: Shifts in costs, performance, or exposure are flagged as they develop.

- Decision application: Insights are applied to leasing strategy, asset planning, capital allocation, and ongoing management.

How to choose your CRE firm's operational data analytics solution

The right commercial real estate data analytics solution supports how CRE teams run buildings and portfolios. Strong platforms connect analytics to operational systems, maintain data quality, and present insight in a way teams can use during review and planning cycles.

When supporting the operational side of a CRE firm, these are the capabilities to look for in a data analytics solution:

| What to look for | What this practically means |

|---|---|

| Automatic operational data capture | Work activity is recorded as structured data as it happens, without manual input |

| Analytics grounded in building operations | Insights reflect response times, recurring issues, asset reliability, risk, and workload |

| Tenant experience visibility | Service quality and communication outcomes are reflected in tenant feedback data |

| Side-by-side property comparison | Properties are compared using the same operational and experience metrics |

| Team and vendor performance analysis | Performance is measured based on service outcomes |

| Drill-down from portfolio to activity | High-level trends can be traced to specific buildings, teams, or tasks |

| Connected workflows | Maintenance, inspections, communication, and compliance data sit in one system |

| Action-oriented insight | Changes that require attention are surfaced clearly and early |

What to look for in operational CRE data analytics platforms

Why are commercial real estate data and analytics important?

Today's CRE decisions carry longer consequences and less room for error than ever before. In recent years, shifting interest rates, pricing resets, and tighter capital markets exposed how fragile intuition-based decision-making can be. As conditions stabilize, confidence is returning, but expectations have changed. According to Deloitte, 88% of global CRE investors expected revenues to grow in 2025, and 81% planned to reinvest profits in data and technology. That investment reflects a clear understanding that future performance depends on the ability to predict, not correct, CRE activities.

At the portfolio level, commercial real estate data and analytics create a shared factual baseline across roles. Property managers use data to understand how buildings operate day to day. Asset managers rely on aggregated views to compare assets, justify capital allocation, and address underperformance. Leasing teams draw on analytics to price space, forecast demand, and support retention. And executives and investors depend on consistent data to explain results, defend decisions, and plan ahead. When these groups work from the same underlying data, decisions align more closely with real conditions, supporting:

- Consistent performance comparison

- Earlier visibility into shifts in occupancy, pricing, and financial risk

- More reliable valuation and underwriting grounded in comparable data

- Clearer justification for capital allocation, reinvestment, or disposition decisions

- Greater confidence in portfolio reporting across stakeholders

How is data analytics used in commercial real estate?

Commercial real estate teams use data analytics to turn large volumes of property, market, and operational data into clearer decisions across the full property lifecycle.

Improving property valuation and pricing decisions

Transaction records, historical pricing, asset attributes, and market movement often live across spreadsheets, broker reports, and internal systems. CRE data analytics bring that commercial real estate property data together so pricing assumptions can be checked against current conditions. Automated valuation models refresh comparables as new data comes in, allowing investors and lenders to spot pricing gaps earlier and adjust assumptions on the fly.

Evaluating acquisition opportunities

Data analytics in commercial real estate allows market performance, visitation patterns, demographic trends, and asset behavior to be reviewed together across potential deals. When evaluating acquisition targets, investment teams can see how a property aligns with existing holdings, where demand looks durable, and where exposure concentrates. This supports faster screening and more consistent decision-making when multiple opportunities compete for capital.

Managing risk across properties and markets

Vacancy shifts, tenant concentration, regulatory exposure, and climate-related risk often emerge gradually. Commercial real estate data and analytics tracks these factors over time, pairing with commercial property inspections and building compliance software to gain earlier visibility into physical and regulatory risk before issues affect asset value or financing terms.

Optimizing rental performance and revenue

CRE data analytics helps teams understand why income is rising in one period and slipping in another. Operators can see where rent increases outpaced demand, where concessions stabilized occupancy, or where pricing lagged behind the market. This view supports more deliberate pricing decisions and steadier revenue, rather than reactive adjustments after vacancies appear.

Strengthening tenant mix and leasing strategy

Commercial real estate property data helps leasing teams evaluate tenant mix by showing how metrics like foot traffic, tenant behavior, and co-tenancy patterns play out over time. Analytics reveals which tenants consistently attract activity and which combinations support stronger performance across the property. This insight informs tenant selection and strengthens negotiation positions during lease discussions, especially in retail and mixed-use environments.

Improving tenant experience

CRE data considers service activity from work order management and CMMS tools, and communication history from tenant apps and tenant communication tools to track response times and repeated issues. This constant visibility helps property teams identify and address problems earlier, enhancing tenant experience and retention and reducing disruption across properties.

Reducing costs while improving operational performance

Operating costs add up, and they accumulate through small, repeated decisions. Commercial real estate data analytics connects maintenance records, vendor activity, and findings from commercial property maintenance and inspection logs to show where budgets are spent. Repeated repairs, uneven vendor performance, or delayed preventive maintenance become actionable information that property teams use to plan predictive maintenance and allocate resources more effectively without sacrificing vendor relationships or service quality.

Why do CRE teams choose Visitt for commercial real estate data analytics?

Visitt is a property operations platform built for commercial real estate. As work orders, inspections, compliance tasks, tenant messages, and vendor actions move through the system, they are captured as structured operational data. That data connects across workflows and forms the basis for CRE data analytics.

When response times change or issues recur, Visitt's platform makes them easy to spot. Asset reliability, compliance exposure, and workload build a clear picture of how each property is performing. Tenant satisfaction data is tied directly to service speed and quality, and communication outcomes, showing how daily tenant operations impact the tenant experience. Teams can compare buildings side by side, then move from portfolio trends down to individual buildings, vendors, teams, and specific activities to see what drives outcomes. And when service slips, workloads concentrate, or assets begin to fail, the data makes those moments clear and points teams to where action is needed.

See how Visitt's data analytics capabilities support your CRE portfolio

Ready to see Visitt in Action?